Cell Therapy Manufacturing: Build or Buy?

As progress in cell therapy hit its stride, 2022 saw several challenges that threatened to slow the pace. These ranged from softening financial markets to operational bottlenecks that limited access for patients. In our panel at Phacilitate’s Advanced Therapies Weeks, we discussed how innovators and their ecosystems persevered to set up the industry for a brighter 2023.

The New Reality of Post-Pandemic Markets

Following bountiful times after the boost from mRNA covid vaccines, biotech capital markets saw a return to normalcy in 2022. Exacerbated by broader macroeconomic conditions (e.g., global conflict, rising interest rates to tame inflation, etc.) the S&P Biotech ETF XBI declined a further 26% after 2021’s initial 20% decline following pandemic-driven increases of 49% in 2020 and 32% in 2019.1 With investors fleeing to safety, biopharma IPOs saw an 80% decrease in funds raised to $3.2B from $15.9B (2021) while venture capital fell 42% to $40.1B.

Despite tightening markets, cell therapy science and commercial progress arguably strengthened. Janssen’s and Legend’s Carvykti FDA approval in February was followed by an expanded indication for Yescarta into second line treatment. In Europe, Atara Biotherapeutics claimed the first allogeneic T-cell therapy approval.

Facing both capital headwinds and scientific tailwinds, innovator companies must balance tradeoffs between building facilities against other clinical and commercial-enabling activities.

Facilities Builds are Costly and Illiquid

Even with accelerated approval timelines, total development and facility costs can exceed a billion dollars.2 GMP cell therapy manufacturing facilities are one of the most expensive components of development and commercialization. A survey of recent facility costs by University College London notes CDMO builds in the low millions to Kite’s $21M expansion in the Netherlands to UC Davis / CIRM’s $61M for research and clinical supply.3 In a current example, SK pharmteco’s integrated facilities spanning plasmid supply, vector manufacturing, cell therapy, and testing will exceed several hundred million USD after construction finishes in 2025.

In 2022, as cash flow tightened, companies had to rationalize portfolios, labor, and facilities. For example, one clinical CAR T developer moved their facility from California to Washington to save $100M.4 Even large pharma5 with commercialized advanced therapies saw the benefit of consolidating facilities to a single site and selling excess capacity to smaller biotechs6 to manage costs and streamline operations.

A Renewed Focus on COGS and Vein-to-Vein Times

Since the first CAR-T cell therapy was approved in 2017, the focus on pricing has stayed at the forefront of industry concerns. With direct dose prices ranging from $373,000 to almost $500,000 and indirect costs for travel, lodging, and post-treatment care not always covered by insurance, CAR-T can out of reach for some patients.7 Even with costs limiting those who can afford treatment, excess demand drove waitlists for a manufacturing slot up to 8 months at 17 cancer treatment centers in 2022.

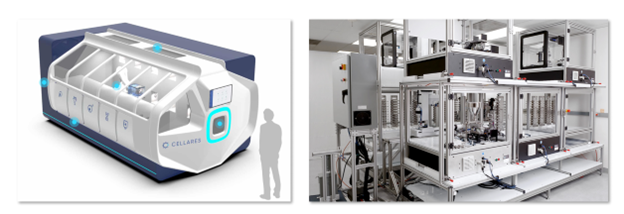

Against these two challenges of high COGS and lengthy vein-to-vein times, innovators have turned to closed pod-based systems8 and robotic-based automation9 andto reduce labor and logistics costs.

Developers of these technologies have modeled the ability to run 10+ processes simultaneously, dozens of doses in parallel, resulting in 70% lower costs and significantly lower process failures10. On the facility standup side, these next-generation technologies are faster to implement than traditional suite designs – breaking ground to cutting ribbon in nine months versus the traditional three to four years.

As a foundation for automation and robotics efforts, manufacturing engineering systems (MES) provide crucial infrastructure with electronic batch records, scheduling, and certification. A benefit of digitized operations is that data can be used for rapid root cause analysis and predictive analytics that otherwise would have been cumbersome or impossible with paper batch record processes.

Switching gears to the underlying science and process, researchers at Penn have demonstrated the ability to alter immune cells within 24 hours versus the standard of up to two weeks.11 If translated into clinical and commercial settings, time, materials, and labor costs would be significantly reduced. Collectively, advances in technology and process improvement will both incrementally improve the status quo while opening doors for leapfrog applications in allogeneic and regenerative medicine (RM)

On the Horizon – Allogeneic Cell Therapy & Regenerative Medicine

Conceptually, both allogeneic (donor-derived starting material) cell therapy and regenerative medicine have promised to upend the current treatment model. Allogeneic therapies offer a substantial cost improvement with dozens to potentially hundreds of doses produced per run12. Beyond the previously referenced approval of Atara Biotherapeutics’ Ebvallo, several companies have progressed into pivotal trials. Allogene (which showed comparable efficacy to the commercial approved Abecma and Carvykti13) and Gracell in allogeneic CAR-Ts and Affimed, ImmunityBio, and Glycostem in natural killer cells are all expected to deliver data in the coming year.

On the regenerative medicine side, there are currently 1000+ active clinical trials at the start of 2023. Some of the most promising include:

There are also eight FDA-approved RMs for hematopoietic stem cell transplants to restore hematopoietic and immunologic in patients with disorders affecting those cellular compartments or those resulting from myeloablative procedures. Other approved medicines include MACI (cartilage restoration in patients with knee defects) and Laviv (reduction of wrinkles in nasolabial fold region).

As challenges with immunogenicity and persistence are evaluated and mitigated over time (similar to how cytokine release syndrome was observed and managed through autologous trials through commercialization14), both allogeneic cell therapies and regenerative medicines will certainly see broader uptake.

De-risking Facility Decisions with Modular Designs

Considering the multiple paths that cell therapy could take moving forward and with the costs associated with putting a stake in the ground, cell therapy developers can find it challenging to commit to a specific process and build. A prefabricated approach to building cleanrooms, such as modular wall panels and offsite qualification and validation of equipment, can minimize upfront costs while keeping options open as the clinical process evolves.

At SK pharmteco, our 700,000 square foot integrated facility was constructed to allow the use of modular wall panels, with cleanroom components and equipment are operationalized simultaneously offsite. Units have been assembled quickly and efficiently in King of Prussia (which allows for more rapid deployment or removal as client processes are determined) and have saved several months in overall construction time compared to more traditional methods.

With broader macroeconomic conditions still uncertain in 2023, SK pharmteco offers cell therapy companies optionality, efficiency, and risk mitigation in preclinical through early trials. For late clinical and commercially approved products, SK pharmteco can help scale quickly to meet patient demand.

References

1. Yahoo Finance. https://finance.yahoo.com/quote/XBI/performance; Retrieved 1/31/23

2. Dimasi et al. Innovation in the pharmaceutical industry: New estimates of R&D costs; https://www.sciencedirect.com/science/article/abs/pii/S0167629616000291?via%3Dihub

3. Pereira Chilima et al. Estimating Capital Investment and Facility Footprint in Cell Therapy Facilities. https://discovery.ucl.ac.uk/id/eprint/10090087/1/Pereira%20Chilima%20et%20al.%20FCI_Final%20Reprint%20Accepted.pdf

4. Sana Biotechnology ditches California manufacturing plans in bid to save $100M; https://www.fiercepharma.com/manufacturing/sana-biotechnology-inks-deal-new-manufacturing-facility-hires-execs

5. Novartis cuts 275 jobs at Illinois site to consolidate Zolgensma manufacturing in North Carolina; https://endpts.com/novartis-cuts-275-jobs-at-illinois-site-to-consolidate-zolgensma-manufacturing-in-north-carolina/

6. Novartis Playing in Cell Therapy CDMO Space with Carisma; https://bioprocessintl.com/bioprocess-insider/deal-making/novartis-playing-in-cell-therapy-cdmo-space-with-carisma/

7. Cost of CAR-T therapy out of reach for some cancer patients and insurances; https://www.beckershospitalreview.com/oncology/cost-of-car-t-therapy-out-of-reach-for-some-cancer-patients-and-insurances.html

8. As Cell Therapy Gains Ground, Efforts Emerge to Improve CAR T-Manufacturing; https://medcitynews.com/2023/01/as-cell-therapy-gains-ground-efforts-emerge-to-improve-car-t-manufacturing/

9. ‘How do you decide?’: Cancer treatment’s CAR-T crisis has patients dying on a waitlist; https://www.statnews.com/2022/06/02/car-t-crisis-cancer-patients-die-waiting/

10. As Cell Therapy Gains Ground, Efforts Emerge to Improve CAR T-Manufacturing; https://medcitynews.com/2023/01/as-cell-therapy-gains-ground-efforts-emerge-to-improve-car-t-manufacturing/

11. Cellares Fact Sheet; https://www.cellares.com/wp-content/uploads/2021/12/Cellares_Fact_Sheet_12152021.pdf; Retrieved 1/31/23

12. Penn Researchers Shorten Manufacturing for CAR T Cell Therapy; https://www.pennmedicine.org/news/news-releases/2022/march/penn-researchers-shorten-manufacturing-time-for-car-t-cell-therapy

13. Commercial Scale Manufacturing of Allogeneic Cell Therapy; https://www.frontiersin.org/articles/10.3389/fmed.2018.00233/full

14. Novel ‘Off the Shelf’ CAR-T Product Shows Promise in Myeloma; https://www.medpagetoday.com/hematologyoncology/myeloma/102943